Deep Seek, Tariff Insights, and Fed Cuts

01.

DeepSeek Pours Cold Water on Big Tech

KEY POINTS

The launch of DeepSeek’s-R1 AI model showed that China’s AI innovation was much closer to matching U.S. counterparts than previously assumed.

DeepSeek's latest model achieved breakthroughs in "reasoning," a critical area in AI research that many experts believe is key to achieving human-level intelligence.

While some estimates suggest DeepSeek needed only around $5 million worth of chips to train an earlier model, it’s unclear if this is accurate. It does not account for research and experimentation, and we don’t know how much computing power was required.

Even still, DeepSeek's innovative engineering techniques may mean that future AI models may depend less on premium chips (hence NVIDIA’s sharp selloff) than previously expected by investors.

ANGLES FOR THE STORY

DeepSeek’s sudden arrival has laid bare the hyper scalers’ forward-looking challenge: how to justify massive capex as they scale up from infrastructure to AI models and applications. Investors increasingly want to know where the ROI will come from.

The counter-argument for DeepSeek’s disruption can be framed through a concept known as “Jevons Paradox.” The narrative here is that efficiency—cheaper, more powerful AI models—may actually fuel greater consumption of AI services and, by extension, drive more demand for high performing chips. The secular thesis to own the hyper-scalers and companies like NVIDIA, ASML, ARM, and Broadcom would remain intact.

It’s also worth noting that DeepSeek made its research public, which could bolster industry-wide innovation and help rivals improve their models—rather than creating an immediate existential threat to them. This is the ‘competition and innovation lifts all boats’ argument.

For long-term investors, the biggest takeaway can be summed up in the words of Salesforce CEO Mark Benioff, when he said: “The pioneers are not the ones who end up being the victors.” In other words, beware of the crowded AI trade and remember diversification is your friend.

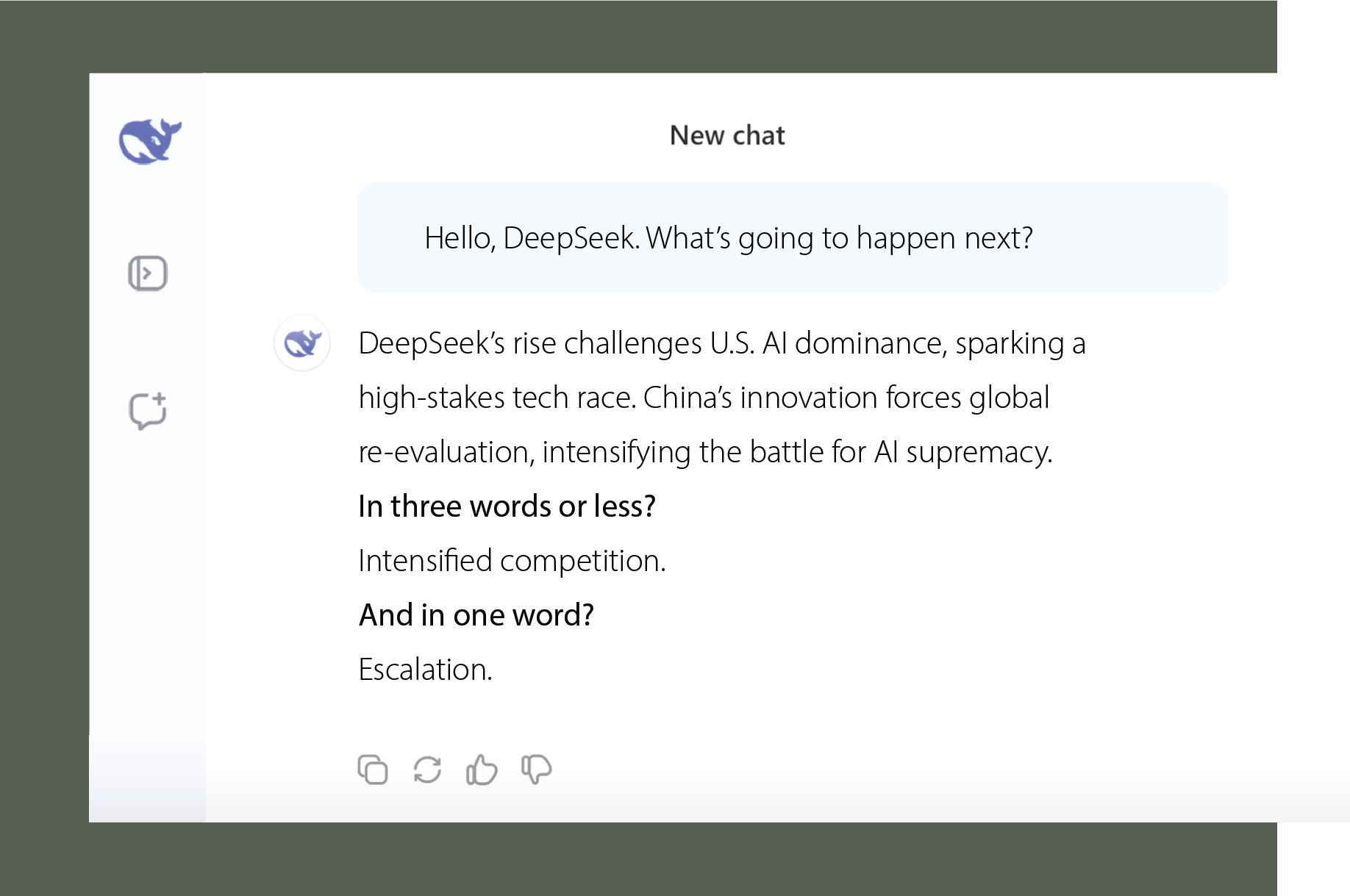

Finally, there’s a somewhat provocative but definitely interesting hook to include in the story.

Take a look at what happened when DeepSeek was asked about the AI race:

02.

How Investors Should Think About Tariffs

03.

The Real Takeaway from the January Fed Meeting

KEY POINTS

Besides holding rates steady (which everyone expected) the Fed did two key things at their January meeting. They confirmed the labor market remained solid, and they removed language about making progress towards their 2% inflation goal.

This was interpreted as somewhat hawkish. Previously the Fed had said the labor market may be faltering, and that inflation was trending in the right direction.

These comments made it sound like the Fed was doing more than just ‘waiting for more data’ before resuming cuts. It felt like the Fed making the case for a longer pause.

To be fair, in the press conference that followed the decision, Chairman Powell said he believed policy was still restrictive, which means there is still a gap between current rates and the neutral rate. There’s just no rush to get there.

ANGLES FOR THE STORY

Fed policy in 2025 just isn’t as important as it was from 2022 to 2024.

Investors still obsess over what the Fed’s next moves will be, but there’s a good argument that we won’t see a meaningful move in the fed funds rate in either direction.

A negative scenario would be if inflation u-turned and climbed back above 3%, which could trigger rate increases. Any other outcome probably isn’t worth much consideration.

If the economy is strong and stable, and therefore doesn’t require further intervention from the central bank, that may irritate traders but should not influence investors at all.

In reality, rate cuts are neither inherently positive nor negative for markets. They are well-known factors that get priced-in ahead of time and are unlikely to disrupt broader economic trends. In 2025, investors would be wise to focus less on central bank maneuvers and more on the underlying health of the economy and corporate profits.