Market Panics, Navigating Tariffs, and AI in 2025

01.

Responding to Market Panics + History Lessons

KEY POINTS

Markets move on expectations vs.reality, and unfortunately the April 2 announcement was far worse-than-expected in terms of size and breadth of tariffs.

When all the tariffs get put into a blender, the effective U.S. tariff rate jumps to ~20%, while baseline consensus was for an effective tariff in the ~10% range.

One positive spin is that the administration’s starting point is at maximally punitive levels, as reflected in the market’s sharply negative reaction.

This implies that any modicum of good news on trade will factor as a positive surprise for markets going forward, which will almost certainly trigger strong moves in the other direction. This should be your content’s ultimate message and focus.

ANGLES FOR THE CONTENT

Remind clients just how critical it is to participate in the strong rallies that follow steep declines, corrections and bear markets.

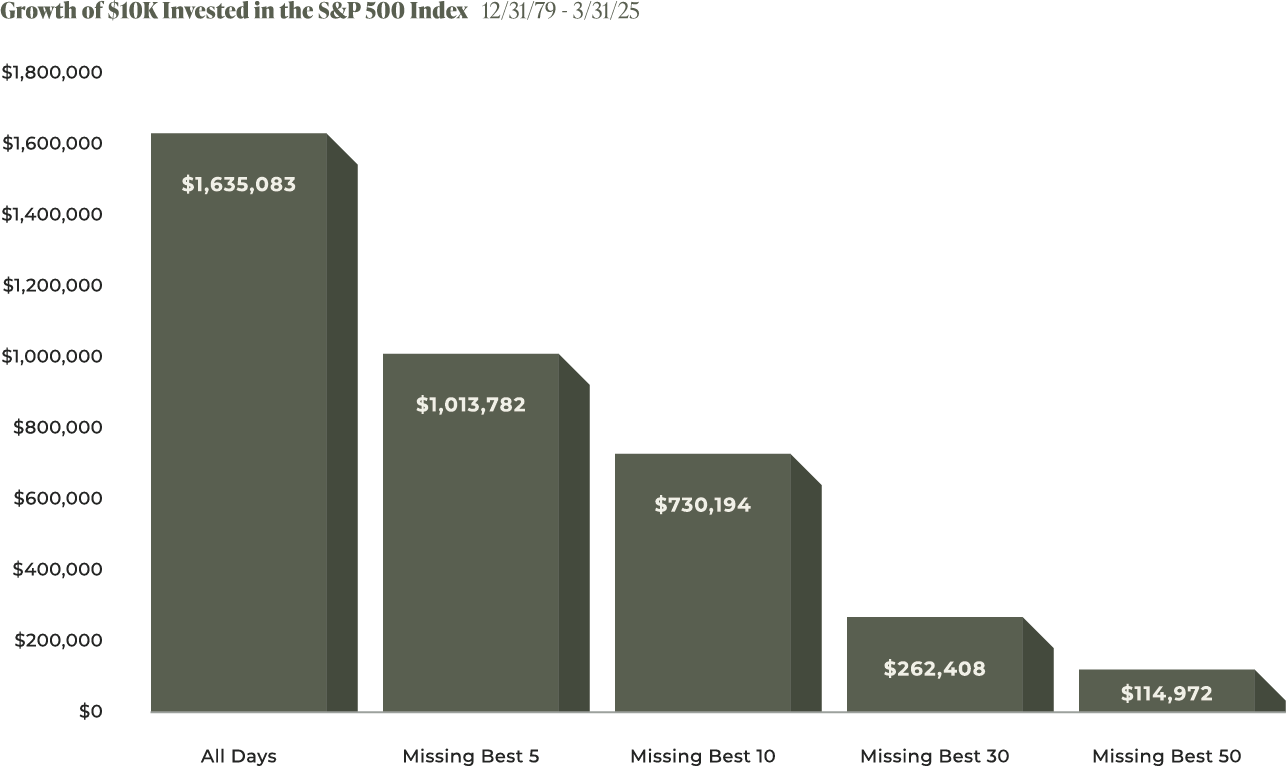

Case-in-point: If you put $10,000 into the S&P 500 on January 1, 1980, and then missed just the 5 best days in the market, you would have given up over half a million dollars.

Remind clients that this would have meant staying invested in the days following the 1987 Black Monday crash and throughout the Tech Bubble, the 2008 Global Financial Crisis, and the Covid-19 pandemic. That’s very hard to do, but throughout history it has paid off.

In a related note, offer clients some statistics about what the S&P 500 has done historically after big down days. The numbers here are very compelling, with history essentially suggesting 100% chance that markets will move higher in the next twelve months.

02.

How to Navigate the Tariff Issue

KEY POINTS

Clients obviously exist across the political spectrum, so it is important not to discuss tariffs in overtly positive or negative terms.

The optimal way to communicate is to have a handle on both sides of the argument, but importantly to arrive at the same conclusion.

ANGLES FOR THE CONTENT AND FOR CLIENT DISCUSSIONS

Making the Pro-Tariff Argument

One of the most influential advisers on trade is the chair of Trump’s Council of Economic Advisors, Stephen Miran. He has a Ph.D. in economics from Harvard University and is a fellow at the Manhattan Institute.

In economic papers, Miran has suggested tariff rates around 20% and potentially up to 50%, compared to the current average of 2%. Miran proposes that such tariffs could serve as compensation from allied nations benefiting from U.S. defense support.

He also argues that the appreciation of the U.S. dollar could mitigate the adverse effects of tariffs, somewhat neutralizing the higher prices of imports.

There is also the idea that universal, permanent tariffs would raise a significant amount of revenue—north of $600 billion per year according to Trump’s chief trade adviser, Peter Navarro.

The argument here is that additional revenue could finance sizable tax cuts, plug the deficit, or both.

There is also the goal that tariffs on all imports would motivate companies to move manufacturing to the U.S., in order to avoid paying the tax—a boon to the domestic manufacturing sector.

It is also possible that foreign producers may opt to lower the prices they charge for exports to offset the tariff, which would mean importers pay roughly the same price.

The bottom line, most-hoped-for outcome is that—as Treasury Secretary Scott Bessent indicated—this is as punitive as tariff policy will ever get.

In other words, the administration is starting at the worst-case scenario place, meaning that any—and perhaps all—negotiations will factor as a positive improvement which should give stocks a boost over time.

In the absolute best-case scenario, we see an outcome much like we did in Trump’s first term. The bark is very loud and shocking, but the bite ends up being far smaller as deals get made and trade barriers and tariffs get lowered. If the world ends up with freer trade because of this work, that would be a major boost for global economic growth and markets long-term. Especially if tax cuts get passed along the way.

Making the Anti-Tariff Argument

Tariffs are taxes, and businesses and consumers are ultimately the ones who pay them.

As written by The Wall Street Journal’s Editorial Board, “if you raise $600 billion more a year in revenue for the federal government, you are taking that amount away from individuals and businesses in the private economy.”

Most clients accept some form of the argument that ‘higher taxes hurt economic growth, and lower taxes bolster economic growth.’ That makes the core framework against tariffs pretty simple: don’t raise taxes, especially as the economy is showing signs of slowing.

This argument should be paired with a discussion about tariffs’ impact on prices. A ~20% effective tariff rate would raise inflation back above 3%, which may curtail the Federal Reserve’s ability to lower rates any further in this cycle.

If higher, longer-term inflation had the effect of pushing long duration Treasury yields higher—which there’s a good argument it would—that move could cause even more equity market pain.

Uncertainty may be what matters most here.

If the Trump administration does not clearly telegraph how and when tariffs get lowered, that could hurt consumer spending and business investment.

The bottom line is that permanent tariffs are harmful, so the hope is that they’re used as bargaining tools—again, like Trump did in his first term—to extract economic concessions from other countries. If Trump can get world leaders to commit to making a deal to lower trade barriers, build more in the U.S., and buy more from the U.S., then the pain could ultimately prove worthwhile in the long run.

The absolute best-case scenario is the same as it is when making the anti-tariff argument.

03.

What’s Ahead for Artificial Intelligence in 2025?

KEY POINTS

Clients are no doubt curious about what will happen next with AI. So it’s smart and worthwhile to provide the occasional insight and update.

AI is no longer just a tool for tech companies. Financial services, healthcare, manufacturing, and education are rapidly integrating AI into core operations—particularly via generative models and automation.

2025 will see the emergence of hybrid workers who combine human judgment with AI-driven efficiency.

The trend is shifting from massive, general-purpose models toward smaller, expert models trained for niche tasks. These models can be more cost-effective, interpretable, and secure.

ANGLES FOR THE CONTENT

Break down how AI is showing up in real, concrete ways in your clients’ world—whether that’s healthcare diagnostics, supply chain logistics, or customer service. Keep it sector-relevant.

Use the concept of hybrid workers to help clients envision how AI might change the nature of their own jobs—or their teams’—by handling repetitive tasks and freeing up time for higher-value work.

Finally, introduce clients to the idea of expert models. Explain how the shift from giant models to focused ones could reduce costs, increase accuracy, and offer more privacy and control.